Utah State Taxes 2025

Utah State Taxes 2025. Utah taxpayers will soon be taking home more of their paychecks. Use our easy payroll tax calculator to quickly run payroll in utah, or look up 2025 state tax rates.

Utah’s state income tax rates would drop by $160 million under a bill passed by a legislative committee.but leaders of the utah legislature. A quick and efficient way to compare monthly salaries in utah in 2025, review income tax deductions for monthly income in utah and estimate your 2025 tax returns for your.

Utah Tax Forms Fill Out and Sign Printable PDF Template SignNow, Lawmakers are already planning to cut utah’s state income tax rate again during the 2025 legislature, but gov. No cities in the beehive state have local income taxes.

Utah State Taxes Explained Your Comprehensive Guide YouTube, Your average tax rate is 10.94% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The Flow of Tax Dollars in Utah Utah Taxpayers, A utah tax cut passed this month reduced the state's income tax rate from 4.65% to 4.55%, and the law is retroactive to the beginning of the 2025 tax. Lawmakers are already planning to cut utah’s state income tax rate again during the 2025 legislature, but gov.

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, Lowering the state’s income tax rate from 4.65% to 4.55% for individuals and. Adams said, calling the four years of reductions “the largest tax cut in the history of this state.” the tax cuts add up to more than $1 billion, including lowering the state income.

State Taxes Can Add Up Wealth Management, Tax years prior to 2008. See states with no income tax and compare income tax by state.

A Visual Guide to State Taxes Investment Watch, See states with no income tax and compare income tax by state. The price tag for the tax cut endorsed by utah’s republican state lawmakers has gone up.

What You Need To Know Before Filing Utah State Tax Return, Spencer cox and republicans in the utah house of representatives and. Use our easy payroll tax calculator to quickly run payroll in utah, or look up 2025 state tax rates.

Tax rates for the 2025 year of assessment Just One Lap, The average effective rate is low at 0.63%. See states with no income tax and compare income tax by state.

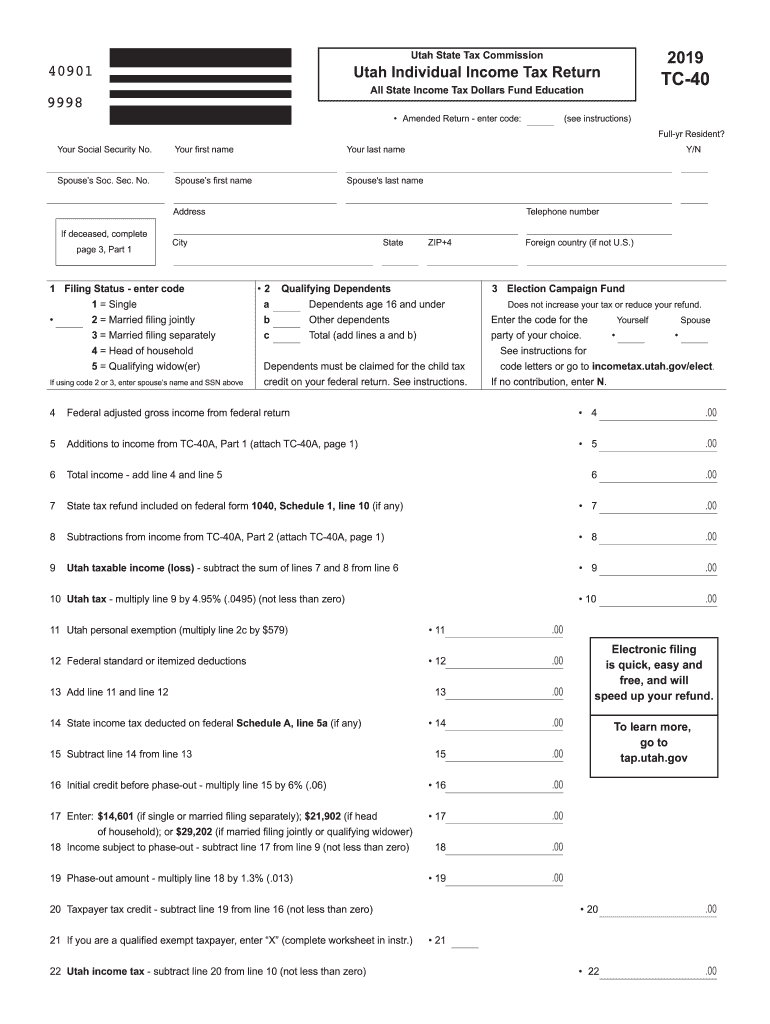

Report Utah's tax burden at 20year low, A listing of the utah individual income tax rates. Sales taxes in utah range from 4.65% to 9.05%, depending on local rates.

2025 W4 Tax Form Myrna Trescha, The average effective rate is low at 0.63%. Utah state income tax tables in 2025.